Taxes are always a big sticking point when any state is looking to launch legal sports betting and Ohio is no different.

After the good news that the Ohio legislature passed HB 29 which allows sports betting in the state, we finally have an update in the form of a possible tax increase. This would appear to be bad for operators with the details still being sorted out in real-time.

Ohio Sports Betting Takes Big Step

While the news of increased taxes to operators isn’t great, even that news can’t damper the passing of HB 29 by the Ohio legislature. After the bill passed both the House and the Senate, the last thing left is for Governor Mike DeWine to sign off on it.

That should be a formality considering he has been very vocal in his support of the legalization of sports betting in the state. Now that there has been an amended bill that satisfies both the Senate and the House, it’s hard to imagine a scenario where he does not sign the bill.

Now for the news that has operators already looking to make amendments as early as 2022; it appears that HB29 calls for operators in Ohio to pay daily taxes. The reason that’s a big deal to operators is, unlike casinos who usually pay daily tax, sportsbooks normally do so on a monthly basis.

To make it a bit clearer as to why this would be an inconvenience for sportsbooks, you only need to consider the business models. The sportsbook industry is inherently more volatile than the casino business and there will be days where you win significantly more than other days. The same applies to losses as well.

With this daily model, sportsbooks could end up paying huge sums on days where they do very well and it appears that they will not be able to balance that out with the inevitable losing days. This is where things get a little tricky.

Negative Carryover Will Not Be Allowed

In most states, sportsbooks are able to write off promotional credits when you look at the effective tax rate. This is quite important to the overall bottom line of most sportsbooks. Some operators are very concerned about how HB29 is worded as it does not appear to allow for promotional credits to be written off.

What that means in layman’s terms is, if a sportsbook takes a loss on a specific day, even if promotional credits were used, there would be nothing for them to deduct those credits against. In other words, the ability to write off credits in Ohio does not have a positive impact on their bottom line as is the case with several other states.

Even right here in the Midwest, in Ohio’s backyard, the state of Michigan has been able to benefit from a similar provision.

Most sportsbooks operate at around a 5% margin so when it comes to how they are taxed, that will essentially make or break their ability to turn a profit. While some people might think that increased taxes are the operator’s problem, it isn’t nearly that simple. If a sportsbook turns on the lights, it’s with the intention of turning a profit one way or another.

Therefore, increased taxes only means worsened odds for players. Again, the sportsbook is going to do what it needs to so while on the surface it might seem like the operators’ problem, in the end, customers are the ones that will suffer most.

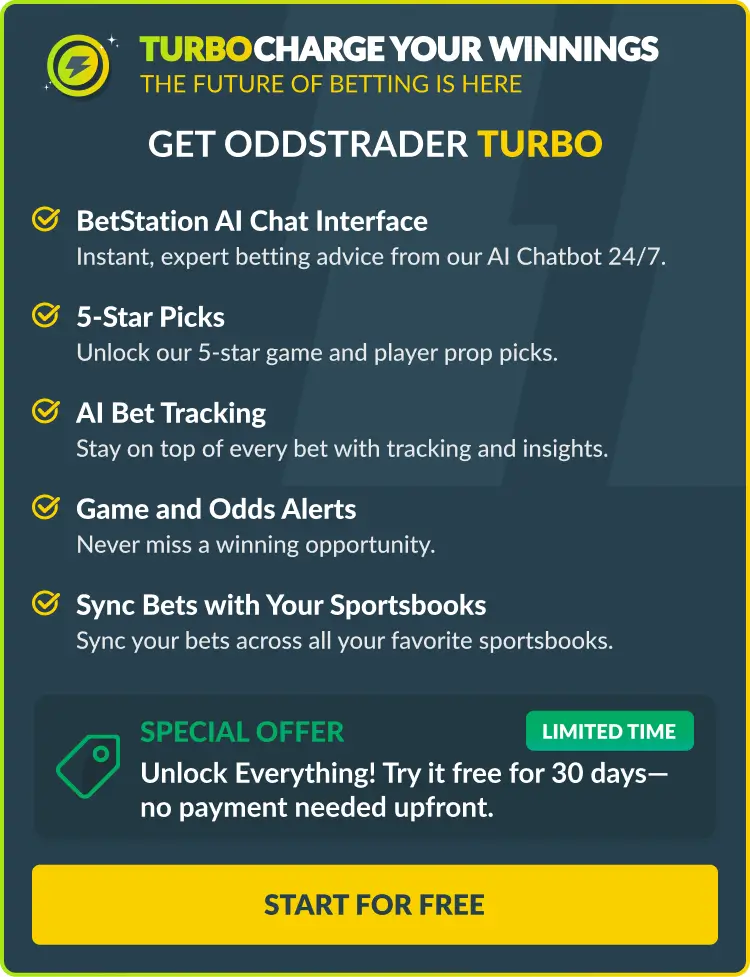

Players in Ohio and across the country that don’t yet have access to legalized sports betting via mobile, can go to Odds Trader once this changes. OddsTrader currently offers betting odds comparison in Illinois, Colorado, New Jersey, Pennsylvania, Tennessee, Indiana, Michigan, Virginia, Iowa and West Virginia.